Introduction

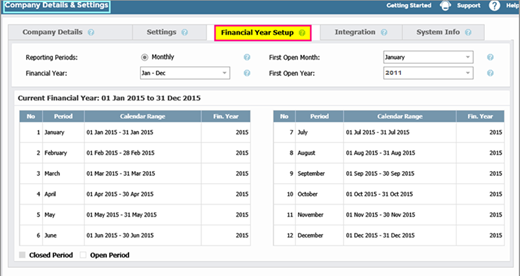

The Financial Calendar is established during the Company setup process. At setup, you can decide on the number of periods in a Financial Year, their start and end dates, and the current Financial Year.

After setup, you cannot change the financial year yourself and must contact your system provider to do so. After creating your first transactions for an entity, Company Details & Settings will no longer have a Financial Year Setup tab. However, you can still view your company’s calendar by going to Setup > Financial Periods Opener.

Deciding on a Financial Year

Most companies use 12 monthly periods, normally coinciding with the Taxation Calendar. However, you can start your Financial Year at any month and run it through to the following year. If you start in the middle of the year, you can also decide to nominate your Financial Year as the current year or the following year. For example, if your financial year commences on April 1, 2022, you can nominate the Financial Year as 2022 or 2023.

Closing Periods

You can carry out transactions on all open forward periods. If your Current open period is period 12, you can still post transactions to as many periods as you want in the following year. You can also run Financial Reporting on all open or closed periods. However, for your final monthly report pack for a period or year, close the period in question. This prevents you from making postings to that period that could render the financial statements inaccurate.

You can close Sales, Purchases, and General Ledger separately, but you cannot close the General Ledger until you close the other two.

Closing Financial Years

For all Ledgers, you cannot close the last Period in the year. Instead, carry out the year end process to:

- Roll over balances in any Assets or Liability Accounts (Balance Sheet).

- Zeroise all Revenue and Expenditure (Profit and Loss Accounts).

- Accumulate the net value of the profit and loss accounts into Revenue Reserve Account in the Balance Sheet.

See:

Period and Year End Management (2.5) - AIQ Academy

Period and Year End Management (2.5) - AIQ Academy

How do I Set Up a New Company or Corporate Entity?

How do I Set Up a New Company or Corporate Entity?

How do I Reopen Financial Periods?

How do I Reopen Financial Periods?

Selecting the Correct Year for Period-based Reporting

Selecting the Correct Year for Period-based Reporting

Closing the Sales Ledger

Step One: Check transactions

Ensure all Sales related transactions for the period in question have been entered and posted. You cannot enter any further Sales Ledger transactions after the period has been closed.

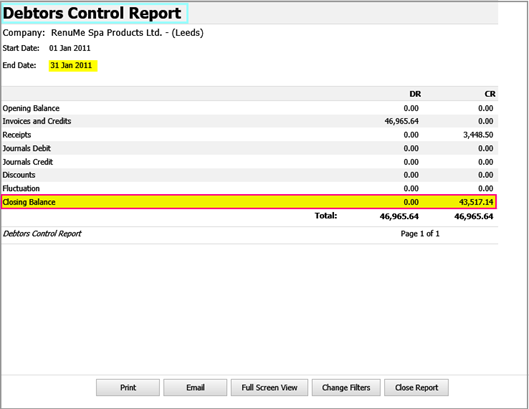

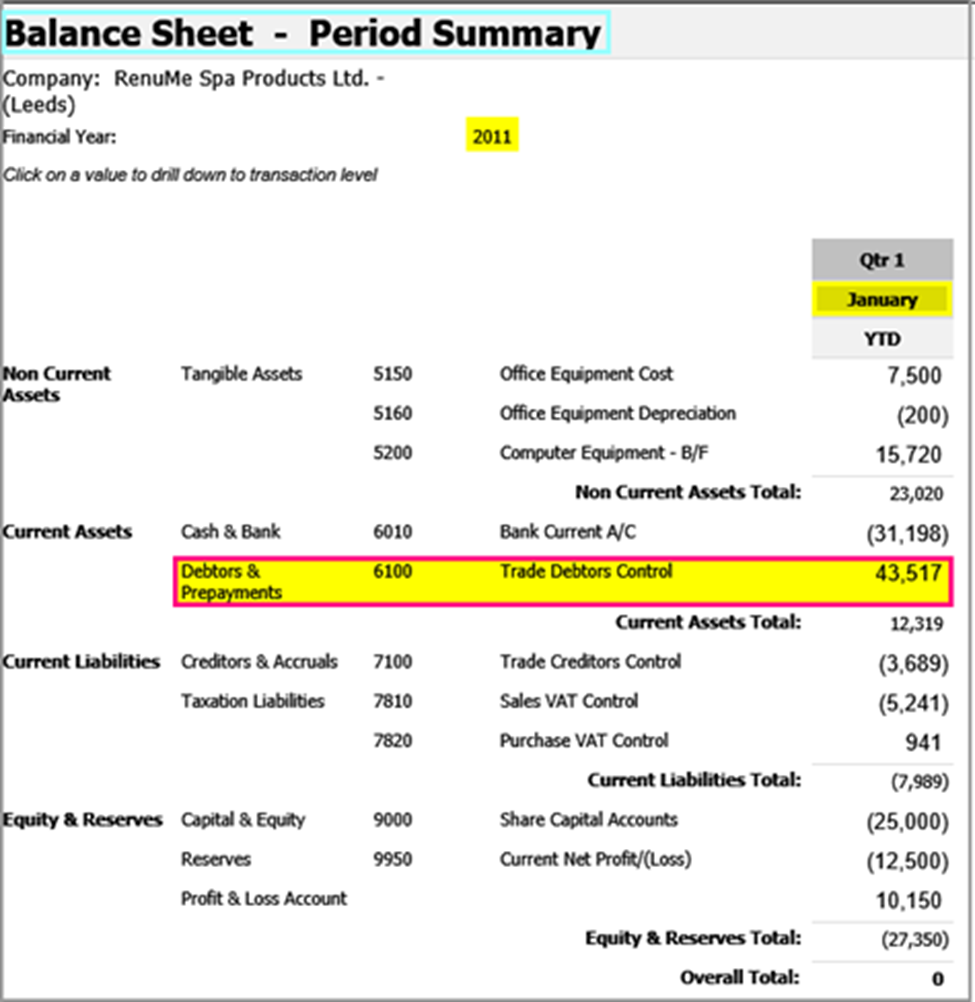

To check that everything is in line, you can run the Debtors Control Report in the Sales system and compare the results with the Balance Sheet – Period Summary in the General Ledger system:

Step Two: Close the current period

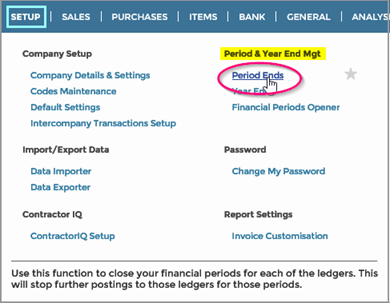

- Go to Setup > Period Ends:

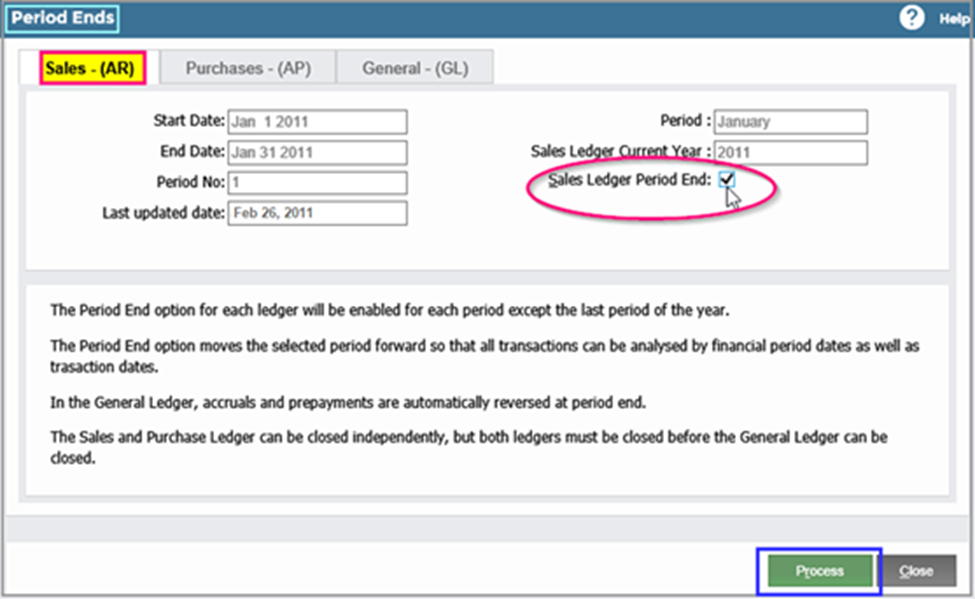

- The Sales – (AR) tab displays the current open period and financial year. To close the period, tick Sales Ledger Period End.

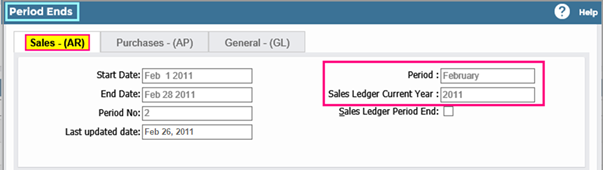

- Click Process. The open period shown will now be the following month.

Closing the Purchase Ledger

- Ensure that all Purchase Transactions for the period in question have been entered and posted. You cannot enter any further Sales Ledger transactions after the period has been closed. Compare the Control Report Creditors in the Purchasing System with the Balance Sheet – Period Summary in the General Ledger.

- Go to Setup > Period Ends.

- The Purchases – (AP) tab displays the current open period and financial year. To close the period, tick Purchase Ledger Period End.

- Click Process. This closes the Purchase Ledger for that period and rolls over the current open period to the next period.

Closing the General Ledger

You cannot close the General Ledger for the period if either the Sales Ledger or Purchase Ledger remains open.

- Ensure all General Ledger transactions have been entered and posted for the period in question. This includes General Ledger Journals, Bank transactions for the period, and Stock transactions. You cannot create transactions that could generate postings for closed periods.

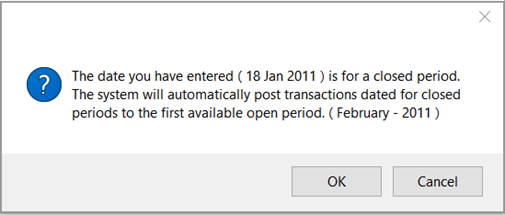

Instead, you will receive a message asking if you would like to post to the next open period:

- Go to Setup > Period Ends.

- In the General (GL) tab, tick General Ledger Period End.

- Click Process. This closes the General Ledger for that period and rolls over the current open period to the next period.

Closing Financial Years

You can close the Sales, Purchase, and General Ledger year ends independently of each other. However, you must close the Sales and Purchase Ledgers before closing the General Ledger.

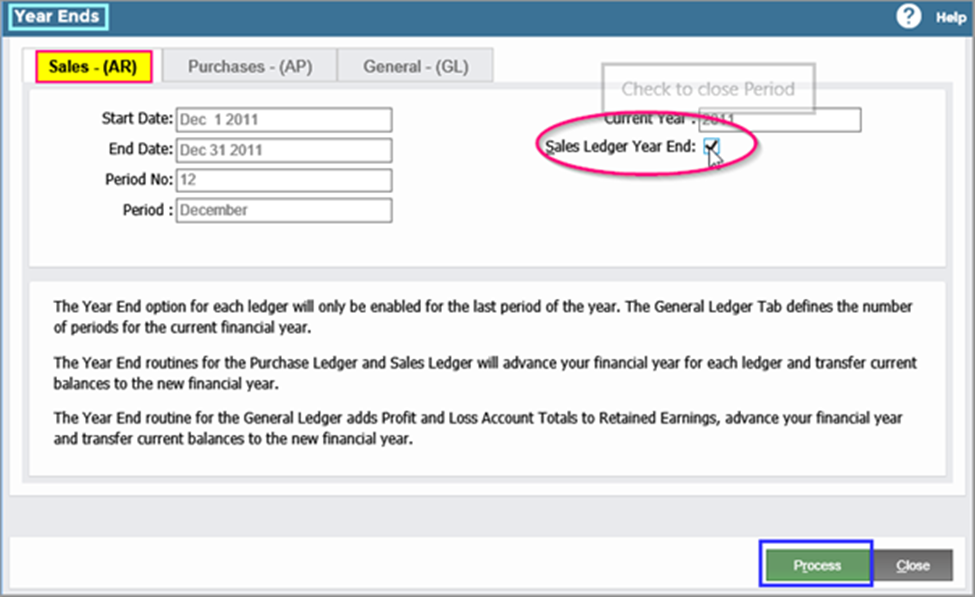

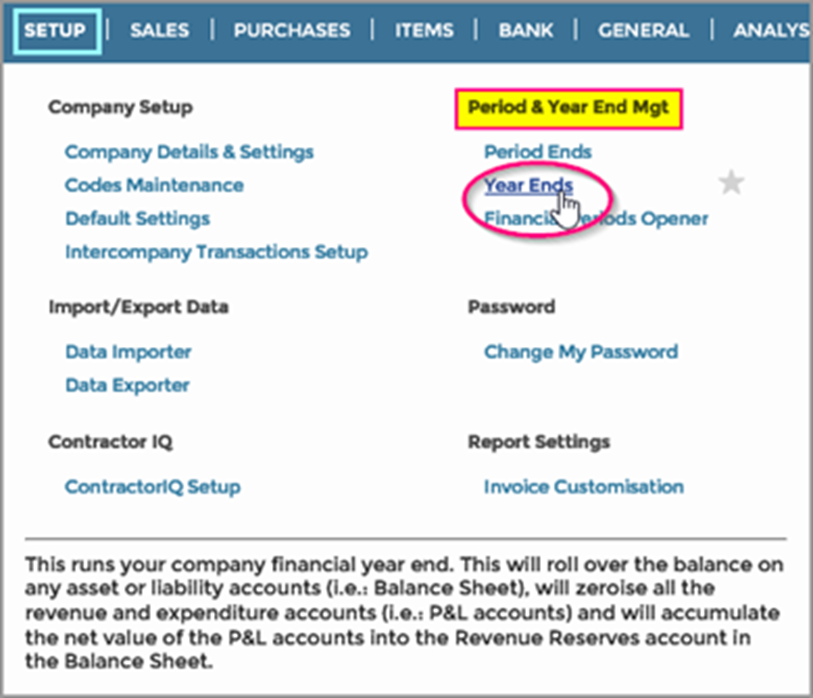

Go to Setup > Year Ends.

Sales Ledger tab:

You cannot close the Sales Ledger for the year unless the current open period is the last one in the financial calendar.

- Tick Sales Ledger Year End.

- Click Process. This will then stop any further Sales Ledger postings with a Transaction Date in the year just closed.

The Current Open Year and Period No. will now be the first period in the following year according to the Financial Calendar.

Purchase Ledger tab:

You cannot close the Purchase Ledger for the year unless the current open period is the last one in the financial calendar.

- Tick Purchase Ledger Year End.

- Click Process. This will then stop any further Purchase Ledger postings with a Transaction Date in the year just closed.

The current open year and period will now be the first period in the following year according to the Financial Calendar.

General Ledger tab:

Before closing the General Ledger, it is advisable to deal with over and under positions. To do this, check the Accrual, Deferred Revenue, Provisions, and Prepayments Accounts in the Balance Sheet.

In the General Ledger tab:

- tick General Ledger Year End.

- Click Process.

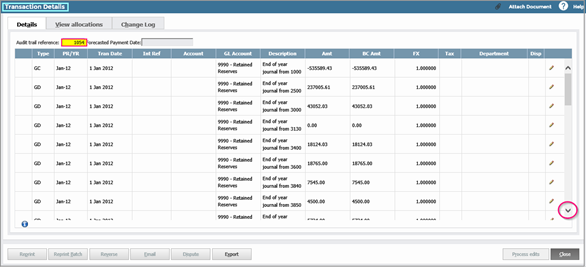

Processing years ends will:

- Close the last period and year to inhibit further General Ledger transactions.

- Advance the current period and year to Period 1 of the following year.

- Clear all Income and Expenditure Accounts and post the Balance to the Revenue Reserves Account by generating a Journal with a series of Debits and Credits against each of the Income and Expenditure Accounts. This will transfer their Balance for the year in question only to Revenue Reserves Account.

How Do I Change Year Ends?

How Do I Change Year Ends?